Do you need a world where you can easily cover your kid’s groceries, pay your parents’ bills, or let a friend handle household costs—all without sharing bank details or stressing about safety?

PhonePe has launched UPI Circle, a digital payment feature that allows Indians to share and manage digital payments. Announced on April 15, 2025, UPI Circle allows users to create trusted payment circles, authorising transactions for family, friends, or dependents seamlessly, securely and inclusively. This isn’t just another app update—it’s a bold step toward making digital payments accessible to everyone. Let’s dive into what makes UPI Circle a revolutionary addition to India’s fintech landscape.

The rise of UPI and PhonePe’s role

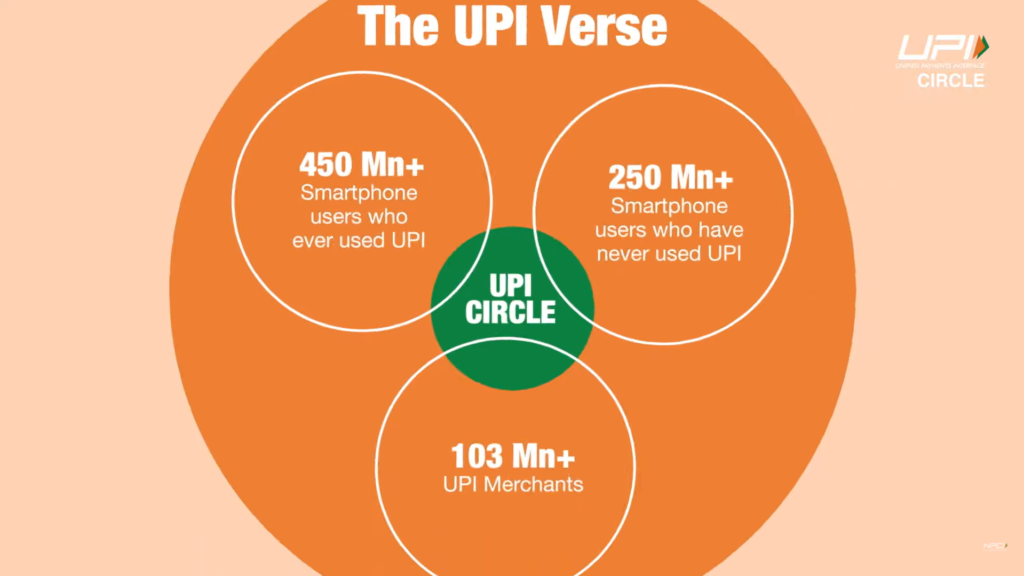

Unified Payments Interface (UPI) has transformed India’s financial ecosystem since its inception in 2016, turning smartphones into virtual wallets for millions. From street vendors to high-end retailers, UPI’s ease and speed have made it the backbone of India’s digital economy.

PhonePe, one of India’s leading fintech giants, has been at the forefront of this revolution. With over 600 million registered users and a network of more than 40 million merchants as of March 2025, PhonePe processes a staggering 330 million transactions daily, boasting an annualised Total Payment Value (TPV) exceeding INR 150 lakh crore.

PhonePe’s user-friendly app and robust infrastructure have made it a household name, but PhonePe isn’t resting on its laurels. The introduction of UPI Circle shows its commitment to pushing boundaries, addressing gaps in financial inclusion and simplifying everyday transactions.

What is UPI Circle?

At its core, UPI Circle is a feature that allows a primary PhonePe user—someone with a UPI-linked bank account—to create a “circle” of trusted individuals, such as family members, friends, or dependents and authorise payments on their behalf. What sets it apart is its ability to generate unique UPI IDs for secondary users without requiring them to have a linked bank account.

This is a game-changer for dependents like students, elderly parents, or anyone hesitant to navigate digital payments independently. Whether it’s a teenager needing pocket money for a movie or a senior citizen wary of online transactions, UPI Circle empowers primary users to manage expenses remotely while giving secondary users the freedom to transact securely.

The setup is straightforward. Primary users can invite secondary contacts via a UPI ID or QR code directly within the PhonePe app. Once the secondary user accepts the invitation, they’re added to the circle and can select the primary user’s account as a payment option. The primary user retains full control, with tools to review payment requests, track expenses, access detailed transaction records and even delink users if needed. It’s a perfect blend of autonomy and oversight, wrapped in PhonePe’s hallmark security protocols.

Why UPI Circle Matters

India’s digital payment ecosystem is thriving, but gaps remain. Not everyone has access to a bank account and even those who do may lack the confidence or know-how to use digital platforms. UPI Circle bridges this divide by extending the benefits of UPI to the underbanked and digitally cautious. At the feature launch, Sonika Chandra, Chief Business Officer of Consumer Payments at PhonePe, enthusiastically said,“UPI Circle is a significant step forward in extending the ease and convenience of digital payments for those who are underbanked and those new to the ecosystem.” She went on and highlighted the new features’ versatility and explained how parents can fund their children’s expenses, busy professionals can delegate household payments and caregivers can assist seniors—all within a secure, controlled digital payment environment.

The feature also taps into India’s cultural fabric, where family and trust play central roles. In a country where parents often manage finances for their kids well into adulthood and extended families share responsibilities, UPI Circle feels like a natural extension of these dynamics. It’s not just about convenience; it’s about empowerment. By giving dependents their own UPI IDs, PhonePe fosters financial independence while keeping primary users in the driver’s seat.

A closer look at UPI Circle’s security and usability

In digital payments, security is non-negotiable and PhonePe doesn’t cut corners. UPI Circle is built with enhanced security protocols to ensure every transaction is safe and transparent. Primary users receive real-time notifications for payment requests and the app’s detailed transaction logs make it easy to monitor spending. The ability to delink secondary users instantly adds an extra layer of control, ensuring peace of mind for those wary of misuse.

Usability is another feather in UPI Circle’s cap. The activation process is intuitive, even for first-time users. Open the PhonePe app, tap the UPI Circle option on the home screen and invite secondary contacts by scanning a QR code or entering their UPI ID. Secondary users join by accepting the invite and voila—they’re ready to transact using the primary user’s account. The seamless integration with PhonePe’s existing app means there’s no need for additional downloads or complicated setups. It’s digital payments done right: simple, secure and inclusive.

Real-world applications of UPI Circle

The beauty of UPI Circle lies in its versatility. Consider a few scenarios:

- Parents and Students: A college student living away from home can use UPI Circle to pay for textbooks, food, or transport, with parents approving and funding each transaction remotely. No cash, no hassle, just a UPI ID that works like magic.

- Elderly Dependents: Seniors who find digital payments daunting can rely on a trusted family member to manage their bills or grocery payments, all while using their own UPI ID for a sense of independence.

- Busy Professionals: A working couple can delegate household expenses—like paying the milkman or ordering groceries—to a trusted helper or relative, streamlining chores without compromising control.

- Shared Expenses: Friends planning a group trip can use UPI Circle to pool funds or settle shared costs, with one person overseeing the transactions for transparency.

These use cases highlight UPI Circle’s potential to simplify financial interactions across generations and lifestyles, making it a tool for modern India.

PhonePe’s broader vision

UPI Circle isn’t just a feature—it’s a reflection of PhonePe’s mission to “democratize digital payments and make financial services accessible to all.” Founded in 2016, PhonePe has grown from a payments app into a fintech powerhouse, offering insurance, lending, wealth management and even consumer tech ventures like Pincode (hyperlocal e-commerce) and Indus AppStore (a localized Android app ecosystem). With UPI Circle, PhonePe reinforces its commitment to innovation, addressing real-world needs with solutions that resonate deeply with Indian users.

The timing couldn’t be better. As India’s digital economy surges—fueled by initiatives like Digital India and UPI’s widespread adoption—features like UPI Circle are poised to accelerate growth. By bringing more people into the digital fold, PhonePe is not only expanding its user base but also contributing to a more inclusive financial ecosystem.

Wrapping Up

PhonePe’s UPI Circle is more than a feature—it’s a bold leap toward a future where digital payments are truly inclusive. By enabling users to create trusted payment circles, PhonePe is breaking down barriers, empowering dependents and simplifying shared expenses in a way that feels uniquely Indian. With its robust security, intuitive design and alignment with India’s cultural and financial landscape, UPI Circle has the potential to transform how millions transact daily. As PhonePe continues to innovate, one thing is clear: the journey to democratize digital payments has just gotten a lot more exciting. Whether you’re a parent, a professional, or a caregiver, UPI Circle invites you to rethink how you share money—securely, seamlessly and with trust at the heart of it all.