AI fatigue might be hitting some professionals, but venture investors are still fully engaged and eager to ride the AI wave. In fact, AI startup deals dominated the venture capital landscape in the third quarter of 2024, accounting for an impressive US$19 billion—28% of all venture funding according to Crunchbase data. A key highlight of this quarter was OpenAI’s record-breaking US$6.6 billion round, the largest venture deal in history. This massive funding was one of six AI rounds that surpassed US$1 billion this year, showing that despite the skepticism, AI startups continues to attract enormous capital.

But OpenAI isn’t the only AI startup making funding waves. Three more AI startups raised more than US$100 million in October 2024, indicating that the AI boom is far from over. Let’s dive in and learn more about AI startups and their funding deals.

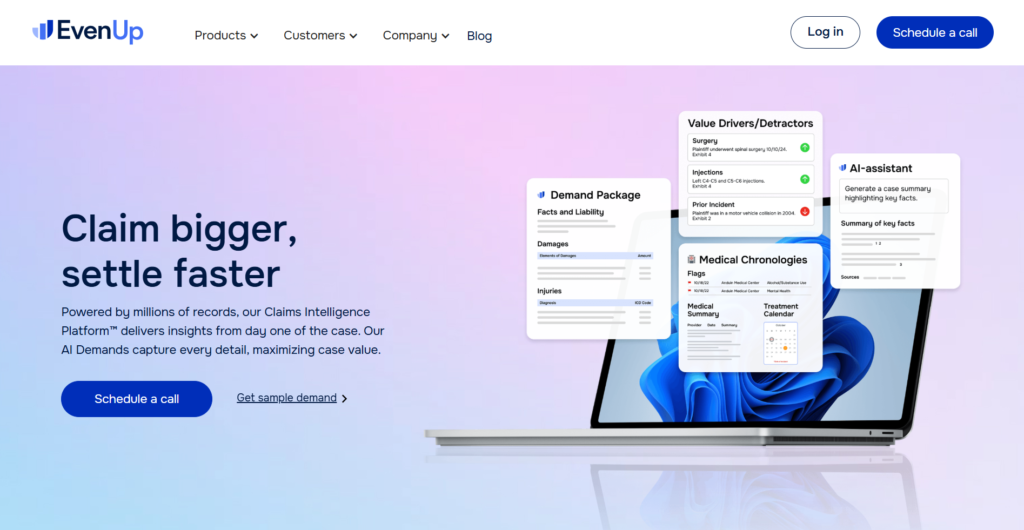

EvenUp: Transforming the legal landscape with LegalTech innovations

Ray Mieszaniec, moved by his father’s unfortunate legal settlement, co-founded the legal tech AI startup EvenUp with Rami Karabibar, an ex-Googler who worked on the self-driving car project Waymo and Saam Mashhad, a defense attorney. This AI-powered legal tech startup, raised an impressive US$135 million in its Series D round on October 8, led by Bain Capital Ventures with participation from Premji Invest, Lightspeed Venture Partners, Bessemer Venture Partners, SignalFire and B Capital Group. This funding milestone valued the AI startup at US$1 billion, marking it as a legal tech unicorn.

“At EvenUp, our mission is to close the justice gap through the power of technology and AI,” said Rami Karabibar, CEO and co-founder of EvenUp. “We empower personal injury firms to deliver higher standards of representation, with the goal of ultimately helping the 20 million injury victims in the U.S. achieve fairer outcomes each year.”

With such a clear mission statement along with offering AI-driven tools, EvenUp aims to automate and streamline legal research and case preparation and help smaller law firms compete with their larger, resource-heavy counterparts.

Investors have been drawn to EvenUp’s success in securing landmark wins for their clients. Their AI platform Piai and its features like Case Preparation, Negotiation Preparation, Executive Analytics and Settlement Repository helped claim over US$1.5 billion in damages and flagged US$200 million in missing documents, leading to settlement increases of up to 30%.

This David vs. Goliath scenario has captured the attention of both the legal world and investors, who see the immense potential of AI in transforming how legal work is done.

KoBold Metals: Mining for the future using AI

Berkeley-based KoBold Metals is tackling one of the world’s most pressing challenges: the sourcing of critical minerals like Lithium and Copper using AI. This mineral discovery AI startup founded in 2018 is being backed by billionaires like Jezz Bezos, Bill Gates and Jack Ma. In October 2024, the California-based AI startup raised a whopping US$491.5 million in a venture round this October, according to an SEC filing. While the investors in this round remain undisclosed, previous backers include top-tier VCs like T. Rowe Price and Andreessen Horowitz.

KoBold’s mission is to lead the mineral exploration technologies to ensure a sustainable supply chain for the future of green energy by using AI to predict the location of rare earth metals and mine them using novel hardware.

The AI company’s success in discovering new deposits in underexplored regions has drawn significant attention from investors. By blending data science, machine learning, and geology, KoBold Metals is seen as a key player in securing the future of sustainable energy production.

With nearly half a billion in fresh capital, KoBold is going to accelerate its exploration activities globally and lead the race to power the future of clean energy.

Poolside: Transforming software development AI-way

Poolside, founded in 2023 by CEO Jason Warner and Eiso Kant, is transforming how software is built, tested, and deployed. Mr. Werner, former CTO of GitHub, who also headed the engineering department at Canonical and Heroku met Mr. Kant in 2017, who co-founded the engineering analytics firm Athenian. They wanted to build an AI-driven assistive tool for devs and that’s what is known as Poolside now. This platform integrates AI into the development process to automate mundane coding tasks so that developers can more more on innovation and creative problem-solving.

AI-driven software development platform Poolside closed a remarkable US$500 million Series B round on October 2, led by Bain Capital Ventures, with participation from Nvidia, DST Global, StepStone Group, Citi Ventures and HSBC Ventures. After this round, the AI startup Poolside was valued at a jaw-dropping US$3 billion, showing the software development market’s confidence in AI potential.

From the funding amount and investors, it is evident that Poolside’s business of developing its own AI models to suggest and autocomplete code relevant to a particular context or codebase has drawn worldwide attention.

As a code assistance platform, Poolside will help companies cut development costs, launch new features rapidly and boost software development accuracy.

“We believe software development will be the first major economically impactful capability in which we will see AI reach and surpass human-level capabilities.” Mr. Werner and Mr. Kant said in a press release. They also said, “The ability to see a problem and build technology to solve it, is a superpower that we want to bring to everyone. The mission is big. The approach is hard. It’ll be expensive. And it’ll be so worth it.”

OpenAI: Record-breaking deal in venture history

When it comes to OpenAI, the numbers are very loud. The AI powerhouse announced its massive US$6.6 billion venture round on October 2, the largest venture deal in history. Led by Thrive Capital with participation from Tiger Global and SoftBank, the round valued the company at a staggering US$157 billion.

Founded by Elon Musk and Sam Altman, OpenAI’s mission is to ensure that artificial general intelligence (AGI) benefits all of humanity. The company’s GPT series, a groundbreaking AI model, has been deployed across countless industries, transforming everything from customer service to creative writing.

Investors continue to flock to OpenAI, as if they are enchanted by its limitless potential. Its AI models are now ubiquitous, with enterprises leveraging the technology to drive efficiency, innovation, and customer engagement. The company’s vision to develop AGI further keeps it at the forefront of AI development.

As OpenAI continues to push boundaries, its next phase of growth will focus on refining AGI and expanding its applications across industries. The future promises even more disruptive innovation from the giant AI startup.

The AI boom will continue

Despite the whispers of AI fatigue, the industry shows no signs of slowing down, the above deals are prime examples. Venture capitalists are more eager to invest in companies that are pushing the boundaries of what AI can do. An AI startup with a solid mission and a great vision is just an AI-away to land great funding deals from investors. In such case, investors are all in—and it’s a good opportunity for innovative AI startups to push boundaries in the AI space and show that the future of AI is bright, bold and undeniably lucrative.